Click here to read the full survey results.

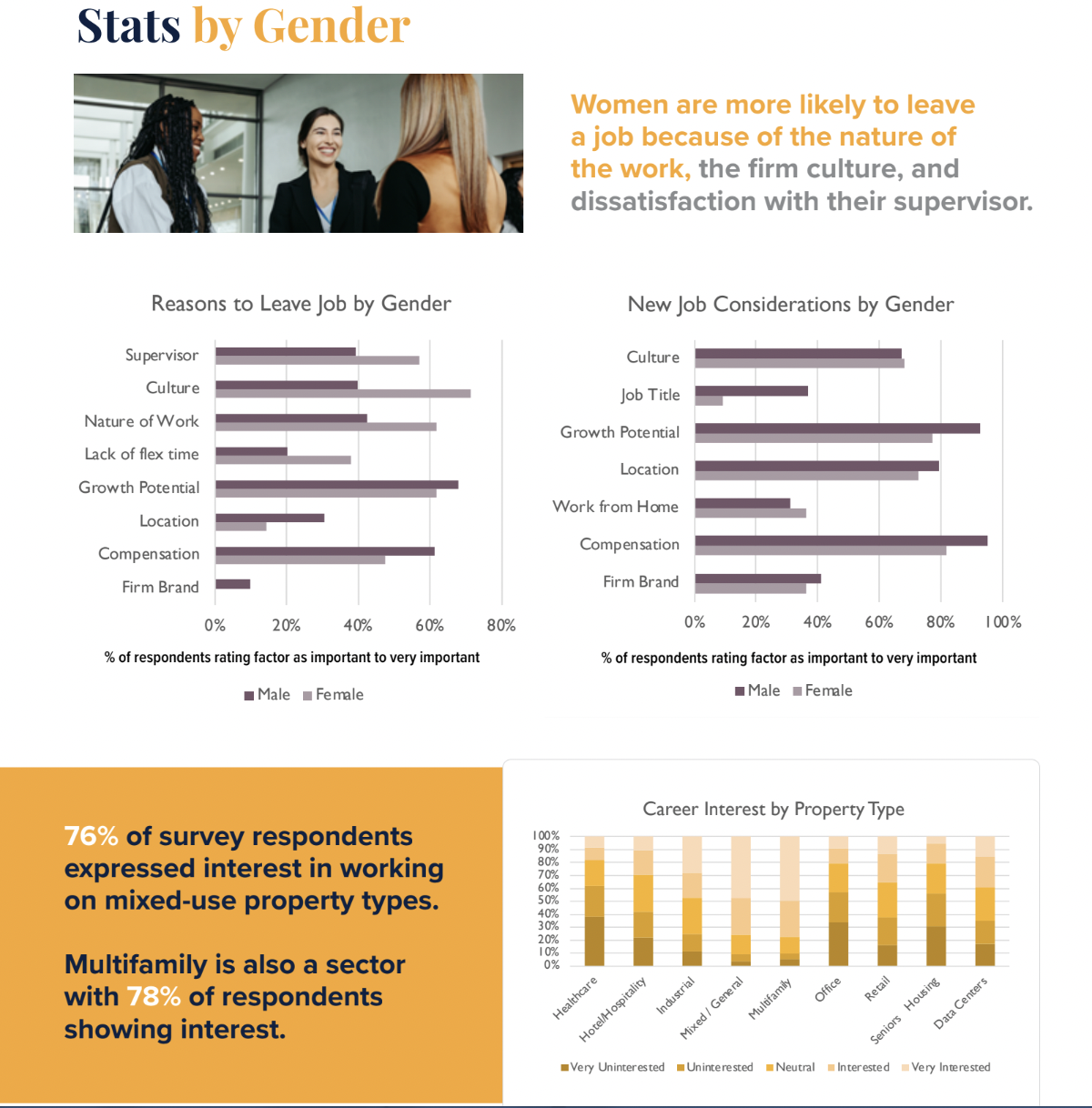

As the Federal Reserve moves into an easing cycle, and with national unemployment still low at 4.1% as of September 2024, financial analysts have a brighter outlook on hiring prospects than a year ago. Only 10% of survey respondents stated that the hiring market is significantly worse than the last year, down from 24%. Additionally, 24% reported that the market is slightly worse, a decrease from 42%. Financial analysts with 0 to 2 years of experience are the most optimistic, with 45% stating that the market has improved, while associates with 3 to 5 years of experience are the most pessimistic, with 41% saying the market is worse than the year prior.

![]() of survey respondents have actively pursued a new job in the past year either at their current employer or another firm. The job market has been active, as even a few people who stated they were not actively looking for a job have had job interviews. Overall, 74% of survey respondents had at least one interview in the past year, with 35% reporting they had four or more interviews.

of survey respondents have actively pursued a new job in the past year either at their current employer or another firm. The job market has been active, as even a few people who stated they were not actively looking for a job have had job interviews. Overall, 74% of survey respondents had at least one interview in the past year, with 35% reporting they had four or more interviews.

Job searches were most common among analysts, with 82% of those having 0 to 4 years of experience actively seeking new opportunities. In contrast, the rate was slightly lower for associates with 3 to 6 years of experience, with 64% pursuing another job during the same period.

How does this compare to last year?

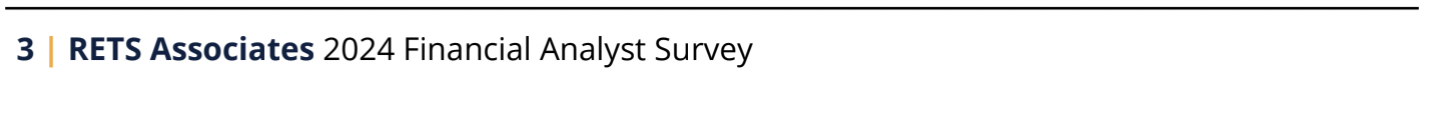

Growth potential and compensation are by far the most important reasons candidates leave their current jobs and what they consider when looking for new jobs, as shown in the graphs below. Dissatisfaction with the nature of work, firm culture, and supervisors are significant factors driving candidates to seek new positions. Location is also an extremely important factor when considering a new job. While 72% of respondents said they would be willing to relocate for a new job, 39% identified their current location as ideal. For those not listing their current location, 60% mentioned New York, Washington DC, San Diego, or Orange County as preferred places.

Women are more likely to leave a job because of the nature of the work, the firm culture,

and dissatisfaction with their supervisor. These factors weigh as highly as growth potential and more heavily than compensation. Flexibility and work-from-home options are also considerations for women, though to a lesser extent. On the other hand, men are more likely than women to prioritize job titles when considering a new position.

Market conditions were somewhat challenging in 2024, driven by monetary tightening, high interest rates, construction in some sectors, and concerns about economic growth, which slowed demand in some property sectors. As a result, compensation was relatively flat in 2024, with reduced bonuses noted particularly for more senior associates with 4 to 6 years of experience.

Average Estimated Total Compensation + Bonus % of Base Compensation

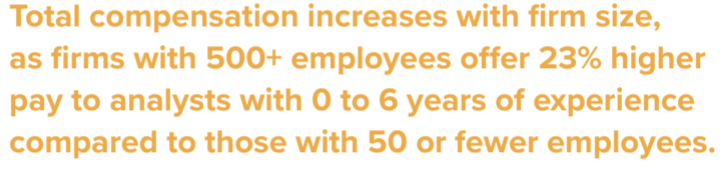

Compensation Compensation did not seem to vary significantly by educational level (Bachelor’s vs. MBA or MRED) or by skills in Argus, Excel, or Waterfalls for each job title. However, total compensation does seem to improve by firm size. In particular, firms that have 500 or more employees show 23% higher compensation for analysts with 0 to 6 years of experience compared to those with 50 or fewer employees.

Analysts find value in working on a variety of property types, which is likely linked to larger companies, as 76% of survey respondents expressed interest in working on mixed-use property types. Multifamily is also a sector of high interest, with 78% of respondents showing interest. Otherwise, interest levels generally align with market trends and property size. Office continues to rank low, with only 21% of survey respondents, compared to industrial (47%), data centers (39%), retail (36%), and hospitality (30%).

*****

Visit www.retsusa.com